The Vehicle Excise Duty (VED) rates for the 2025/2026 financial year were brought in on 1 April, with the standard rate increasing by £5 to £195 a year. This included electric vehicles for the first time.

UK car tax changes can be confusing (it’s worth noting VED and road tax are the same thing), so in this post we’re going to explain everything you need to know about the new car tax rates.

Is my car taxed?

If you’re concerned about your car tax or wondering when it is next due, you can check your vehicle tax on the UK government’s vehicle enquiry service. Visit our How to check if a car is taxed and MOT’d blog post to find more information on how to manage your car tax and MOT reminders.

How much is my car tax?

You’ll need to pay tax for 12 months when you first register a vehicle.

The standard rate for the majority of petrol or diesel, electric and alternative fuel cars is now £195 a year. First-year rates are usually slightly lower and will be based on the vehicle’s CO2 emissions.

If your car was registered before April 2017 or is classed as being a higher-polluting vehicle, you may have to pay more. Vehicles with a list price of more than £40,000 also face an extra £425 a year VED unless they are zero emission or registered before 1 April, 2025.

What tax band is my car in?

To find out how much your road tax is going to cost, you’ll need to find out the year of your car’s registration. This is displayed on page one of your V5C logbook.

The first tax payment rates when you register the vehicle are listed below:

| CO2 emissions | Diesel cars that meet the RDE2 standard Petrol cars Alternative fuel and zero emission cars |

All other diesel cars |

| 0g/km | £10 | £10 |

| 1 to 50g/km | £110 | £130 |

| 51 to 75g/km | £130 | £270 |

| 76 to 90g/km | £270 | £350 |

| 91 to 100g/km | £350 | £390 |

| 101 to 110g/km | £390 | £440 |

| 111 to 130g/km | £440 | £540 |

| 131 to 150g/km | £540 | £1,360 |

| 151 to 170g/km | £1,360 | £2,190 |

| 171 to 190g/km | £2,190 | £3,300 |

| 191 to 225g/km | £3,300 | £4,680 |

| 226 to 255g/km | £5,490 | £5,490 |

| Over 255g/km | £5,490 | £5,490 |

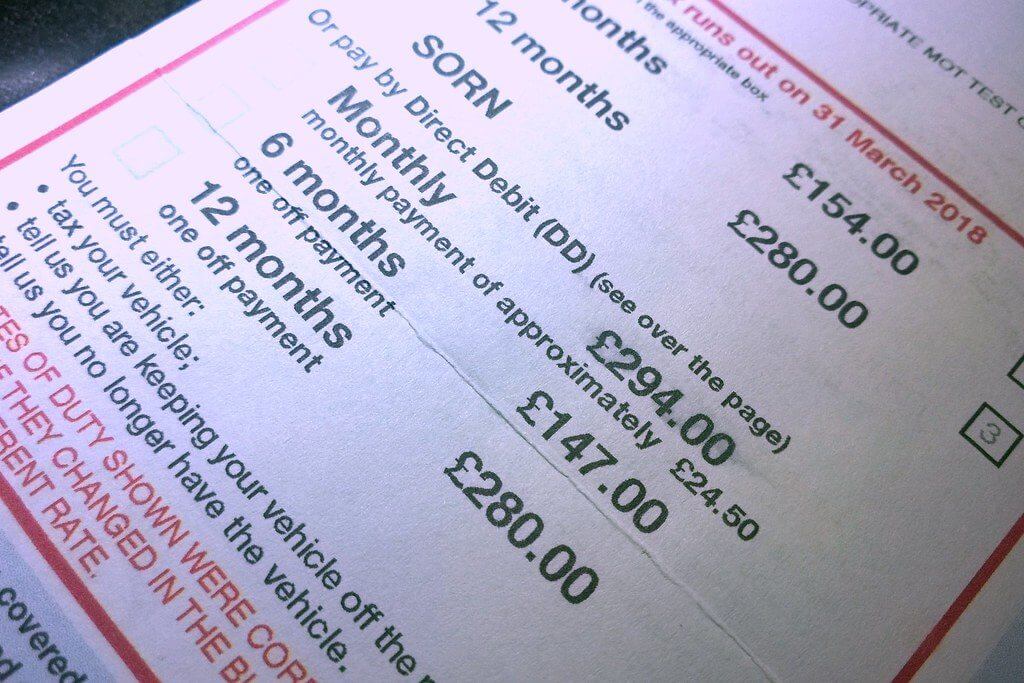

Once you’ve made this 12-month payment, you’ll have the choice of the following rates for your second tax payment onwards:

- Single 12-month payment: £195

- Single 12-month payment by Direct Debit: £195

- Total of 12 monthly payments by Direct Debit: £204.75

- Single 6-month payment: £107.25

- Single 6-month payment by Direct Debit: £102.38

Can you tax a car without insurance?

In short, yes but you will have to factor in some considerations including making sure the temporary car insurance policy is active on the day you tax the car. The vehicle must also have a valid MOT if it’s over three years old (four years in Northern Ireland).

You can find out more in our Can you tax a car with temporary insurance? blog post.

How is my car tax calculated?

Your car tax is based on one of the following, depending on when it was first registered:

- Engine size

- Fuel type

- CO2 (carbon dioxide) emissions

If your car was registered on or after 1 April, 2017 it will be taxed against a zero, standard or premium VED band. Cars registered between 1 March 2001 and 31 March 2017 are split into different CO2 bands. The lower the emissions, the lower the vehicle tax.

When do I need to pay my car tax?

You’ll need to pay your car tax on an annual (or 6-month) basis. You should receive a letter from the DVLA telling you when it’s due. This is typically sent out around a month before the day you have to renew. If you don’t receive this letter, you can check if a vehicle is taxed on the UK government’s website.

Your car needs insurance to be eligible for tax. We have a blog post that explains how to check if a car has insurance.

Car tax exemptions

The following types of vehicle are exempt from vehicle tax:

- Vehicles used by a disabled person

- Disabled passenger vehicles

- Historic vehicles (those made before 1 January, 1985)

- Mobility vehicles and powered wheelchairs

- Electric vehicles

- Mowing machines

- Steam vehicles

- Vehicles used for agriculture, horticulture and forestry

- Vehicles with a Statutory Off Road Notification (SORN)

What happens if I don’t tax my car?

It’s illegal to drive a vehicle in the UK without the necessary road tax. If you are caught driving without tax, you could face a fine of up to £1,000.

You need insurance, whether that’s an annual or temporary car insurance policy, to tax your car. When applying for tax, the DVLA checks whether your vehicle has a valid MOT and insurance. If you don’t have both, you won’t be able to tax your car.

If you’re found to be the registered keeper of an untaxed vehicle, you could face an £80 fine. This can be reduced to £40 if paid within 33 days.

Your car could also be clamped and taken to an impound if it is not taxed. This would result in the following fees:

- £100 clamp release fee

- £200 impound release fee

- £21 per day storage fee

- £25 fee if V62 supplied for new keeper

All of the above are subject to conditions, which you can find in the government’s vehicle enforcement policy.

A vehicle is stored in an impound for a statutory period of between 7 and 14 days. If the vehicle is not claimed within this time, it may be disposed of by auction, breaking or crushing. To get a car released from an impound, you will need impound car insurance.

There will also be a surety fee if the keeper has not taxed their vehicle by the time it is released.

- £160 for motorcycles, light passenger and light goods vehicles

- £330 for buses, recovery, haulage and goods vehicles

- £700 for exceptional loads and heavy goods vehicles such as a large lorry or bus

This can be refunded if proof of this tax is produced within 14 days of the payment being made.

Frequently Asked Questions

Will VED road tax increase for owners of polluting and older vehicles in 2025?

Yes, owners of older and more polluting vehicles will have to pay more expensive road tax after the rates were increased on 1 April, 2025.

VED rates for vehicles registered between March 1, 2001 and March 31, 2017 are based on CO2 emissions, while vehicles registered on or after 1 April, 2017 have moved up to the standard annual VAT rate of £195.

What happens to my road tax if I sell my car?

Inform the DVLA that you have sold or no longer own the car and they’ll be able to issue a refund for any full months left on your vehicle tax. The processing time for this, which can be done online or via telephone, tends to be around six weeks. Find out more on the vehicle tax refund section of gov.uk.

How do I pay my car tax?

You can pay for your car tax via debit or credit card, or Direct Debit. You must tax your vehicle even if it’s exempt e.g.if you are disabled.

You’ll need a reference number to pay for your car tax. This can be found in:

- A recent vehicle tax reminder or ‘last chance’ warning letter from DVLA.

- Your vehicle log book (V5C).

- The green ‘new keeper’ slip from a log book if you’ve just bought it.

If you do not have any of these documents, you’ll need to apply for a new log book. You can tax your vehicle at the same time.

You can find more information on the vehicle tax section of the UK government’s website.

Is VED the same as car road tax?

Yes, Vehicle Excise Duty is also known as road or car tax. It is the annual tax paid by owners of vehicles registered in the UK.