While there is no specific family car insurance policy, this term can be used to describe policies that cover multiple drivers of vehicles. This makes it easier for you to manage car insurance for the whole family as you will know exactly what each member is covered for.

These kinds of policies could even save you money, thanks to the number of discounts that may be available.

Types of family car insurance

Multi-car insurance – This option allows you to insure multiple cars, usually registered at the same address, at the same time. The policyholder can add different policyholders to each vehicle and add named drivers to any cars. You can either get one policy for various cars or a linked policy for the different cars (one policy that links individual policies together).

Named drivers – If you want more than one person to be able to drive your car, you can add them as a named driver. They’ll have the same level of cover as you but you must drive the car the most. If a named driver uses the car more often than the main driver, this is an illegal practice called fronting that can invalidate the policy.

Temporary car insurance – Looking for a short-term solution that lets other family members drive your car? Temporary car insurance could be just what you are after. This flexible solution allows your family members to drive your car for a set amount of time – typically between an hour and four weeks.

Learner driver insurance – Is one of your children learning to drive? According to the DVSA, the average learner takes 47 hours of driving lessons with an approved instructor and 22 further hours with friends or family before passing their test. Temporary learner driver insurance allows family members (or friends) who meet certain requirements to supervise a learner out on the road.

What is covered with family car insurance?

You can cover your family with the three levels of car insurance:

- Comprehensive – Covers the cost of damage to third parties, your vehicle and personal injury, even if the accident was your fault.

- Third party – Covers the minimum costs in case of an accident e.g. injury to a driver or passenger in another car and damage to another person’s car or property.

- Third party, fire and theft – The same as third party but you can also claim for your vehicle if it’s damaged by fire or stolen.

Comprehensive is not necessarily the most expensive policy. Get a range of quotes that suit your needs to find the most suitable policy for you and your family. Your insurer may also be able to offer add-ons to complement your insurance including motor legal protection and breakdown cover.

What is not covered with family car insurance?

You need to ensure any family car insurance plan works for you, as well as your family. If you decide to go with a lower level of insurance, you might not have the level of coverage you need. Adding extra drivers to your policy could also potentially put up the price of your premium.

After getting a quote that covers your family’s car insurance, make sure you read all the details to ensure that it works for you and your loved ones. Amending a policy after purchasing can be time-consuming and expensive.

How does family car insurance work?

There are some options when it comes to arranging car insurance for the whole family.

You could consider a multi-car insurance policy. This is a convenient option if you are happy to have multiple cars at your home and want them all to be covered under one policy. You’d be able to drive any car on the policy as long as you are a named driver. Most insurers allow you to cover between five and seven vehicles on a single policy.

Some insurers even cover family members who live at different addresses as part of their multi-car insurance e.g. children who are studying at university or people working away from home.

Probably the most common is to add named drivers to an existing policy.

Adding a named driver will enable other qualified drivers in your family to legally get behind the wheel of your car on an occasional basis, as long as they are named on the policy. They will be covered in the case of any accident or vehicle damage.

Adding a named driver means:

- You could move to having one car at home, saving money on insurance, tax and general wear and tear and maintenance of existing vehicles

- You can share the driving on longer journeys

- Children who only need to drive occasionally are able to set off in your car, whenever they need to

- Someone else can drive your car in case of emergency

With this type of insurance, named drivers have the same level of cover as the main driver e.g. if you have a comprehensive policy, they will as well. This means if they cause an accident, your vehicle and anyone else – plus injuries – would all be covered.

If they have their own insurance as a main driver, they should contact their insurer to let them know they are a named driver on an additional policy.

The main driver will be the person who does the majority of the driving. If the named driver ends up doing most of the driving, they would be committing an illegal offence called fronting. Penalties and punishments for fronting can include:

- A potentially unlimited fine

- Up to six penalty points on your licence

- Your insurance company potentially voiding or cancelling your policy

- Claims you make potentially being voided

- Possible criminal prosecution for car insurance fraud

- A potential criminal record

It’s often cheaper to add a named driver at the time of your annual car insurance renewal. This is because you’ll avoid paying a mid-term adjustment (MTA) admin fee at this time.

To add a named driver, contact the insurer direct and be prepared with the following information:

- The full name of the named driver

- Their date of birth

- Their main occupation

- Their driving licence number

- Details of any convictions, accidents or claims from the past five years

Please note an insurer can refuse cover to an additional named driver for a variety of reasons.

Temporary car insurance is another option. This gives you the flexibility to cover other family members as and when they need to drive your car. From one hour up to 28 days, many temporary policies are fully comprehensive and won’t affect your no claims discount, meaning you’re covered if they do have a bump while out and about.

Is someone in your family learning to drive? Let them get some extra driving practice in with learner driver insurance. This temporary policy helps a learner gain confidence while being supervised by a family member or friend.

Is a family car insurance policy cheaper?

As with many aspects of insurance, this will depend on various circumstances including age, experience and the types of vehicles being insured. All drivers and vehicles being covered under the same policy could make things easier to manage and there is the potential to save money, especially for those who are listed as named drivers.

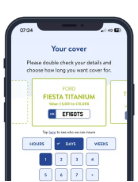

One way of insuring occasional drivers is temporary car insurance. With this type of insurance, you only need to pay when they actually drive. Tempcover offers fully comprehensive cover from 1 hour to 28 days – and you can get a quote in under 2 minutes.

Temporary car insurance for the family can help you in a number of scenarios:

- Your children are back from uni for the holidays and want to drive your car to get around.

- You want to become a one-car household, but would like other members of your family to be able to drive your car.

- There’s an emergency and someone else in your home needs to drive the car.

- It will give you peace of mind that your no claims discount (adding a named driver to an annual insurance policy is likely to affect this) won’t be affected if another named driver has a bump or crash.

Pros and cons of family car insurance

Arranging car insurance for the entire family can sometimes work out cheaper and more convenient, but there are benefits and disadvantages to arranging your insurance this way.

Pros:

- Potential to save money – Having all the family insured under one policy could potentially save you money, especially if it’s a one-car policy.

- Convenience – Have your children flown the nest and are planning on coming home during the university holidays? Instead of the expense of them owning, insuring and maintaining their own vehicles, temporarily insure them to drive yours once they’re home.

- All-in-one solution – Nobody likes to have mountains of paperwork to wade through when they want to find out the finer details of their policies. Having all the family on one plan means everything you need will be in one place.

- Potential discounts and bundles – Insurers may offer a number of special deals on family or multi-car policies. Shop around to find the best deal for you.

- Flexibility – Some policies may let you tailor coverage to each family member’s needs

- Only pay for when they drive – Temporary car insurance means you’ll only have to pay when your family wants to drive your car.

Cons:

- Can be expensive – If one member of your family is inexperienced or has points on their licence, this could increase the cost of the overall premium.

- Annual policies are especially costly – In addition to the above, there could be a significant outlay if you are purchasing an annual policy that covers all the family.

- All on the policy could find their premium increase – If one person commits an offence or makes a claim on a shared annual insurance policy, this could increase costs of the premium as there is shared liability.

- Potential restrictions – There can be restrictions imposed on both vehicles and drivers, especially if they are not based at the policyholder’s address.

When is family car insurance not suitable?

Covering the whole family under one insurance policy is not the most suitable option for every driver. You should think carefully as sometimes individual policies work better for your needs and the way you drive your car.

You should also factor in that if someone is unfortunate enough to have an accident or damage your car, there is potential for the premium to rise.

Looking for another type of cover?

If you’re not interested in getting car insurance for your whole family, you can still get an individual policy that applies to your needs. From temporary van insurance and temporary bike insurance to annual policies for almost every type of car, you can get a policy that offers the level of coverage you need.

Can I add family members to my existing car insurance policy?

Yes, you can add family members to an existing car insurance policy. Simply contact your insurer and ask if you can add a named driver to your policy. Please bear in mind that some insurers may charge an administration fee for making these changes to an annual policy.

If you’re happy to insure family members for a shorter period of time, temporary car insurance could be the answer. Tempcover’s fully comprehensive policies are flexible to your needs.

Will adding a named driver on my car insurance policy affect my no-claims discount?

Adding a named driver to an annual insurance policy is likely to affect your no-claims discount as this tends to be only for the main driver. Please check your insurance details for more information. With Tempcover’s temporary car insurance, your no claims discount will not be affected as it is a completely separate policy.

Which family cars are the cheapest to insure?

Honest John’s Cheapest family cars to insure 2024 article highlights the following family cars as being affordable to cover. Every car on this list has a version that belongs in a low group rating (ranging from 8 to 13):

- Kia Stonic

- Dacia Duster

- Hyundai i30

- Skoda Kamiq

- Skoda Scala

- Skoda Octavia

- Ford Focus

- Citroen C4

- Hyundai Tucson

- Nissan Qashqai

What Car? defines a family car as a mid-sized hatchback that’s bigger than a small car with seating for five adults plus a useful amount of boot space.

Whatever family car you are looking at, make sure you are fully covered. If you can’t find the right annual insurance policy for your family, it’s worth considering temporary car insurance.

This will give those you love the most the freedom to get where they need to go and you the peace of mind that they’re fully insured on their travels.

Frequently Asked Questions

Can I get family car insurance if I’m not married?

As family car insurance is a term that covers getting insurance that covers any type of family, you will not need to be married to get a policy.

Do we have to live at the same address to get a family car insurance policy?

This will depend on the terms and conditions of your insurance policy. Many policies will allow immediate family members who don’t live at the address all year round (e.g. students at university) to drive the covered car.

Can I drive all the cars covered under a family car insurance policy?

As long as you are either the main driver or named driver, you will be able to drive any car covered under this policy. The main driver must drive the vehicle the majority of the time. If a named driver does this, then you will be guilty of fronting and could face a fine, six points on your licence and even a potential ban from driving.

What is the difference between a family car insurance policy and an individual car insurance policy?

The majority of annual insurance policies relate to an individual (the policyholder) and their vehicle. If you want to get more members of your family covered, you can add them as named drivers by contacting your insurance provider. You can also get them covered on a short-term basis using temporary car insurance or look into purchasing a multi-car policy.

Sources

https://www.confused.com/car-insurance/guides/what-is-fronting

https://www.uswitch.com/car-insurance/adding-a-named-driver/

https://www.confused.com/car-insurance/multi-car

https://www.independent.co.uk/advisor/car-insurance/family-car-insurance

https://www.honestjohn.co.uk/guides/cheapest-family-cars-to-insure/

https://www.independent.co.uk/advisor/car-insurance/family-car-insurance