If you’re concerned about your car tax, worry no more. Checking if a car is taxed (and when tax is due) is a relatively simple process. The UK government website has a straightforward vehicle tax checker that will let you know if you’re covered or need to take action in a matter of minutes. All you need is to enter your car’s registration number.

How to manage your car tax and MOT reminders

Insurance, tax and a valid MOT are essential requirements for the vast majority of cars owned and driven in the UK. Although this has been the case for many years, the DVLA’s system has evolved enormously.

One example of this evolution is how the once-mandatory tax disc – physical evidence of tax being paid – was replaced by an entirely digital system in 2014. Although there are many benefits to digitising this system, it does mean it’s now just that little bit more difficult to see when your – or anyone else’s – tax is due.

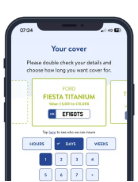

How to check car tax and MOT

- Head to https://www.gov.uk/check-vehicle-tax

- Enter the registration details of the vehicle

- Confirm this is the vehicle you’re looking for

- Tax and MOT details will be revealed

Along with the expiration dates of the vehicle’s tax and MOT, the final page will also provide the following essential information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How do I get a car tax reminder?

With the penalties for forgetting to pay your road tax potentially costing thousands of pounds, it’s so important to ensure everything is legal before you head out on the road. All drivers are sent a v11 reminder letter a month before their car tax expires.

How can I check when my MOT is due?

Failing to get your MOT in time and driving without a valid MOT certificate can also land you with a hefty fine of up to £1,000. You can check the status of your MOT on www.gov.uk.

If you’re worried about forgetting your MOT due date, you can sign up for the DVLA’s free Get MOT Reminders service. By doing this, you’ll receive a notification a month before your car’s MOT is due. This gives you plenty of time to book in your test.

What happens if I drive without tax?

Driving without car tax can lead to severe penalties including:

- A fine of up to £2,500

- The DVLA can clamp your vehicle until the correct tax is paid

- Additional penalties if your vehicle has not declared SORN.

If you’re caught driving without tax, you could be fined up to £2,500. The Vehicle Excise and Registration Act 1994, also known as VERA, means the DVLA can also clamp your vehicle until you pay the correct amount of tax.

If the DVLA flags an untaxed vehicle that hasn’t been declared SORN, the registered keeper will receive a letter issuing notice of a penalty and fine of £80. If this is paid promptly (within 33 days), there may be a 50% discount offered. No points will be added to the driver’s licence at this point but if the fine is not paid, the case may be referred to a debt collector.

|

Penalties for driving an untaxed vehicle on a public road |

|

| Without SORN | With SORN |

|

|

|

|

|

|

What is a v11 letter?

The DVLA sends out a letter to remind car owners when their annual road tax is due. It includes:

- Details of the owner

- The car registration

- Expiry date

- How much you need to pay

When you receive your v11 letter, there will be a link to the government website, phone number and code to pay your tax and you’ll have the choice of monthly direct debits or one-off payment. Obviously, choose the one that suits your circumstances but our advice would be to make sure you set up either payment asap.

All this means it’s actually quite easy to get your car taxed and MOT’d every year, but we’d still recommend making a note in your calendar for a little extra reassurance.

You can also tax your vehicle without a v11 reminder.

What happens if my direct debit doesn’t come out?

Spreading monthly payments can make it easier to afford your car tax, but you need to make sure that you have the necessary funds in your bank account. If a payment to the DVLA fails, you will be sent an email and four days later they will attempt to take the payment again.

If it fails a second time, you’ll receive an email informing you that the direct debit has been permanently cancelled and that your car is no longer taxed.

Driving without tax is a criminal offence so you’ll need to set up a new direct debit with sufficient funds or arrange payment by another method asap. If you don’t and still decide to drive your car, you could be fined £80.

Can I buy a car that’s already taxed?

Unfortunately, road tax no longer carries over with the ownership of a vehicle. This means if you buy a car that has already paid for three months’ road tax, you’ll still need to pay road tax from the day you own it if you want to get behind the wheel.

If you sell a car that still has part of the year’s road tax leftover, you can ask to be reimbursed but bear in mind it will be taken from the 1st of the next month. This means, if you made your request on the 15th you’d still be charged for the weeks left until the new month begins.

Do SORN cars need to be taxed?

If you decide to export or scrap your car, you need to notify the DVLA as quickly as possible. When you do, they will tell you to apply for a SORN (Statutory Off Road Notification) and as long as your car remains off the road, it will remain valid and not need to be taxed (although you can still insure a SORN car).

No road tax? No insurance!

If your car isn’t taxed, then it won’t be insured. This means you not only run the risk of being fined but also potentially end up in more serious trouble if something happens to your car e.g. if your car is stolen or you’re involved in an accident, your insurance will be invalid and you could end up paying out substantial amounts of money that could have been avoided.

As soon as you want to drive your car on a public road, even if it’s just a case of parking outside your house, you’ll need to pay road tax. Once you’ve paid your vehicle tax to get the car back on the road, you will want to insure it.

One solution could be temporary car insurance. This short-term policy will provide you with fully comprehensive cover for a time period (between 1 hour and 28 days) that works for you.