Can I insure a car I don’t own?

The short answer is, yes, you can insure a car that you don’t own – and there are different ways you can do this.

Even if someone else insures a car, you can have third-party protection through your own policy if you have driving other cars (DOC) cover. However, most people tend to choose a temporary car insurance policy or ask for their name to be added to the registered keeper’s existing policy for that car.

How can I insure a car I don’t own?

Insuring a car you don’t own is simple – and there are a few ways you can go about it, depending on your situation.

Temporary car insurance

If you only need to be insured for a short period, temporary car insurance is an effective option. It offers drivers the flexibility to get insurance as and when they need it for as long as they need.

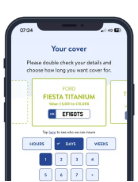

You can get temporary car insurance for as little as one hour or up to one month, depending on the provider and policy you choose. You’ll just need to provide your personal details and the registration plate of the car you’d like to be insured on.

Get your own policy

You can also get your own insurance policy for someone else’s car. A single car can be covered by more than one policy. However, this might not be the most cost-effective approach when you don’t own the car.

It may be sensible to go for temporary car insurance if you’re borrowing the car for a short period or ask if your name can be added to the main driver’s policy for that car if you plan to drive it more frequently.

Named on driver’s insurance

If you plan to drive someone else’s car regularly and temporary car insurance isn’t enough, you could ask for your name to be added to their policy. This means you won’t need to take out your own insurance policy to be eligible to drive the car.

Make sure you both understand the terms and conditions that apply when doing this. This can affect the premium of the main driver. For instance, if any named drivers have an accident and need to make a claim, it could affect the policyholder’s no claims discount and premium price.

There are other things to consider beyond this:

What is fronting?

You need to be careful not to fall into the trap of ‘fronting’, which is where someone insured on someone else’s car drives it more frequently than the person who is named as the main driver. This is classed as insurance fraud and is against the law. Sometimes, less experienced drivers engage in fronting to save costs. Due to rising cases, the Insurance Fraud Bureau (IFB) has issued warnings about the consequences of fronting. This is thought to be caused by record-high quotes being issued, particularly to young drivers.

What happens if I don’t have the right car insurance?

Legally, you must have motor insurance to drive in the UK. Beyond this, you need to have at least third-party cover, regardless of whether you own the car or not. Otherwise, you could face serious penalties.

If you’re caught driving without the correct insurance, the police could give you a fine and penalty points. However, if your case goes to court, you could get an unlimited fine or be disqualified from driving altogether.

These conditions apply whether you’re driving your own vehicle or someone else’s. It’s also illegal for someone to allow you to use their car unless you have the correct insurance in place.

Can you buy insurance for a car you don’t own?

Yes, unless you are added to someone else’s insurance policy, you can buy your own insurance to drive someone else’s car.

It works in a similar way to insuring your own car and involves taking out a policy with an insurance company. You’ll need to you would like to be insured to drive someone else’s vehicle. Your other option is to secure temporary car insurance.

Who is the registered keeper of a car?

The registered keeper of a vehicle is the person who uses the car the most and is classed as the car’s main user. The registered keeper is the main, primary user of the car. This information can be found in the V5C registration document.

On the other hand, the owner is the person who has purchased the car or a person who has been gifted the vehicle. This applies to company cars – where the company owns the car – or when parents buy a car for their children.

Responsibilities of the registered keeper include making sure the vehicle is taxed, has an up-to-date MOT certificate and is roadworthy.

Can you get insurance if you don’t own a car?

Yes, so long as you are legally able to drive, you can be insured on someone’s car with permission and as long as you meet the criteria of the insurance company. It doesn’t matter whether you own or have ever owned your own car.

How long can I be insured on a car I don’t own?

This comes down to how long the owner and registered keeper is happy for you to be insured on their car. Most car insurance policies are renewed annually, so this will likely prompt discussions on whether you should remain on someone’s policy or be removed.

When taking out temporary car insurance, you can select a length of time that suits you and the registered keeper. You can get policies on an hourly, daily, weekly and monthly basis.

I already have fully comprehensive cover, will this cover me?

If you own a car and have fully comprehensive cover, this isn’t enough to cover you when driving a car you don’t own. This is because the insurance covers the car, not the driver – and isn’t transferrable from vehicle to vehicle. For this reason, you’ll need to take out a separate policy to drive a car you don’t own.

Occasionally, comprehensive cover will include a ‘driving other cars’ (DOC) clause with third-party-only protection. However, not all comprehensive policies don’t include this. Bear in mind that if you regularly drive someone else’s car, it may be worth being insured on their car under their main policy.

How long does it take to be insured on someone else’s car?

Taking out temporary car insurance is designed to be quick and easy so you can be on your way as soon as possible. You can get a quote within a couple of minutes with Tempcover.

If you get added to someone else’s policy, you’ll need to provide them with your details such as:

- Your name

- Your date of birth

- Your occupation

- Any driving convictions

- Details of any accidents you’ve been in

To take out your own policy on someone else’s car, it may take a little longer – just as it would if you were taking out a policy for your own car.

How much will it cost to take out insurance when driving a car I don’t own?

There is no set answer, but factors that will be considered include:

- Your age

- Your address

- Your occupation

- Your driving history

- Your chosen level of cover (e.g. comprehensive or third-party)

- The vehicle you plan to drive (and how secure it is)

- Your claims history

- Your no claims bonus

- Your excess

Get temporary car insurance with Tempcover

The flexibility of temporary car insurance can be beneficial – it can open up options when you might otherwise be restricted. At Tempcover, we’ve issued temporary car insurance to thousands of customers over the past 15 years. We’re rated ‘Excellent’ on Trustpilot based on over 30,000 reviews!

To get started, simply get a quote online. Alternatively, if you would like to speak to our friendly team about arranging temporary car insurance you can get in touch via our live chat or by completing our online form. Alternatively, you can email contactus@tempcover.com for more information. Or try our Help Centre which covers a variety of insurance topics.

Frequently Asked Questions

Can I be the registered keeper of a car but not own it?

If you’re the registered keeper, this means you’re the person who’s using and keeping the vehicle. This doesn’t always mean you own or pay for the vehicle though. The owner might be someone different.

Can I insure a car if I am not the registered keeper?

You don’t have to be the registered keeper to insure a car. However, it’s worth bearing in mind that some insurers may be more reluctant for you to be insured unless the registered keeper is a partner, family member or employer. If you are leasing your car, this should also be ok, as the leasing company will technically be the registered keeper and owner.

Just make sure your insurer is fully aware of the circumstances.

Can I be a named driver without my own insurance?

If you have been added to someone else’s insurance as a named driver, you won’t need to take out your own insurance policy to drive their car.

You can be a named driver on someone else’s policy, while also owning your own car with its own car insurance.

Can I own a car but someone else insure it?

You can be the registered keeper of a vehicle and not be the insurance policyholder.

Although most insurers will assume that you own the car you want to insure, they may also acknowledge that you could be a parent, partner or an employer that pays for the vehicle on someone’s behalf.

Make sure you check the details when seeking an insurance policy, as some insurers may be more hesitant than others where someone is the policyholder but isn’t the registered keeper.

Why might I need to borrow a car that doesn’t belong to me?

- You might not own a car

- Your car might be elsewhere (e.g. it might be at the garage)

- You might want to borrow a bigger car (e.g. for moving house)

- You might be asked to drive someone else’s car