When it comes to arranging temporary car insurance, there are many things to bear in mind while trying to find the best deal for your needs.

You can use price comparison sites like Confused.com to find the lowest price, but it’s often worth doing some extra preparation and research to ensure the policy has everything you need.

One of the key things to consider while comparing temporary car insurance is what you will use it for:

- Are you using a personal car for business purposes?

- Dealing with an emergency?

- Is your vehicle in the garage for an MOT, repairs or service?

- Taking a car out for a test drive?

- Driving a new car home after buying it?

- Selling your car?

- Sharing the drive on a road trip?

- Borrowing a car from a relative?

- Borrowing a larger vehicle such as a van to move home?

- Learning to drive?

- Do you need to temporarily cover a car that doesn’t have an annual policy?

Some of these policies have restrictions on who is accepted e.g. temporary van insurance only covers vans up to 7.5 tonnes and temporary learner driver insurance will only be granted to learner drivers.

Do you already have insurance?

Even if you have an existing annual policy, temporary car insurance can be a practical solution for covering additional needs e.g. driving another vehicle or letting someone else drive yours.

Your temporary insurance will cover you to drive another vehicle with no impact on your existing policy e.g. it won’t affect any existing no claims discounts. While the Driving Other Cars clause used to be commonplace in most comprehensive policies, this is not always the case in more recent policies.

Check your insurance documents to see if you need to get temporary cover to drive someone else’s car – or for someone to drive yours. Just remember to ensure your temporary policy doesn’t conflict with your annual policy in case of a claim.

You can also get temporary car insurance to cover someone to drive your car.

How long can I get temporary insurance for?

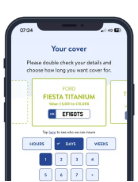

Most temporary car insurance policies can last from a few hours up to a month (Tempcover’s policies last from one hour to 28 days).

This flexibility and convenience, plus how easy it is to get a quote and then confirm payment, makes temporary insurance the perfect solution when you need quick and comprehensive cover to drive a new vehicle.

Once your policy has expired, you can easily arrange a new policy for another 28 days. If you’re not driving the car between temporary policies, registering it as SORN (Statutory Off-Road Notification) ensures you’re compliant with UK law.

When researching and comparing temporary insurance, it’s worth considering who the insurance is aimed at (and whether you are eligible for it), how long you need the policy for (are you looking for hourly, daily, weekly or monthly coverage?) and what type of vehicle the cover is aimed at e.g. you can’t insure a car on a van insurance policy.

You should compare what each temporary car insurance policy offers and how these apply to you and your needs.

How can I get cheaper temporary car insurance?

Everyone is looking to save money, not least when it comes to buying any kind of insurance – especially temporary. Tempcover works with a group of established insurers to provide you with an extremely competitive quote.

If you’re only an occasional driver, it may be worth taking out a temporary car insurance policy only when you drive as this can work out cheaper than paying out for a full 12-month policy.

If you drive safely and sensibly and have no points on your licence, our insurers will view you as a lower-risk driver. This will be reflected in the quote for your policy.

To save money during temporary car insurance comparisons, you should look out for discounts and avoid unnecessary add-ons. Bear in mind younger and high-risk drivers may face higher premiums.

Do I need any extras included?

In order to save some money – in case the worst happens and you’re unfortunate enough to have to make a claim – you could take advantage of Tempcover’s optional Excess Reduction Cover add-on. This reduces your excess to a small fee, meaning you can recover most of what you paid as excess if you’re at fault for an incident, the incident was partly your fault or the third party can’t be contacted.

How can Tempcover help me?

When comparing your next temporary insurance quotes, remember to Tempcover It! Our fully comprehensive policies are designed to help you get where you need to go – fast.

From temporary car insurance to temporary motorbike insurance, Tempcover has you covered. We also offer temporary European car insurance when you’re driving abroad. Whether you’re visiting friends who live in another country or popping over the Channel for a week or two’s holiday, this short-term cover can save you money and the hassle of altering an existing policy. It also lets a friend or relative drive your vehicle for the duration of your stay, without affecting your annual policy or no claims bonus.