What is temporary car insurance?

Temporary car insurance is short-term cover that’s available from as little as one hour up to 28 days – perfect for when you need to borrow a car, pick up a new vehicle or share a long drive.

There are no long-term contracts, meaning you don’t have to worry about adjusting existing cover or adding another name to a current policy.

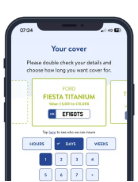

You can take out insurance quickly and easily with Tempcover. We’ll compare prices from our panel of insurers and get a quote to you in under two minutes, so you’ll be fully covered and on the road in no time.