For many drivers, their van is a lot more than just a vehicle. For some, it’s the backbone of their business, while for others, a van is a handy way of transporting large items and helping out family and friends.

If you don’t have the correct van insurance, you could face fines and points on your licence. If you’re borrowing a van or only use one occasionally, you could get temporary van insurance to save on an annual policy.

Whatever you use your van for, you’ll need to make sure you’re legally insured before hitting the road.

Is van insurance more expensive than car insurance?

Yes, van insurance can be more expensive than car policies. The cost of your van insurance depends on the type of van you have. What you intend to use it for and the crime rates in the area you’re keeping it will also come into account.

Why is van insurance so expensive?

Vans are often used to transport large, valuable items and equipment. Because of this, they’re more likely to attract thieves than a smaller car.

Van insurance can be more expensive than car insurance because the provider needs to cover you against break-ins. Van break-ins can happen at any time of day, even while you’re working on a job, so it’s important to take extra security measures and make sure you are covered for every eventuality.

Although it’s recommended to move valuables from a van overnight (please note these will be covered by different insurance premiums), this is not enough to stop opportunist thieves from attempting to break in. If you forget to take your valuables out and your van is damaged, the last thing you need – on top of all the emotional distress and sorting out the replacements – is to pay a huge amount in repair bills.

Another reason that van insurance policies can be more costly is because of the larger size and shape of the vehicles. Vans’ solid sides and backs reduce visibility, which can increase the likelihood of an accident.

Van insurance and how you use your vehicle

One of the first things your van insurer will want to know is how often and for what purpose you’ll be using your vehicle. It’s important to be open and honest. If your van is for personal use rather than business, make sure you tell your insurer as this can impact how much you pay and what you’ll be covered for.

The value of your van’s contents is likely to be much lower if you’re transporting personal items rather than specialist tools and equipment, a fact that can reduce the cost of your insurance premium.

Most insurance providers will ask you to estimate the number of miles you’ll drive each year to get an idea of how much you intend to use your vehicle. If you’re only using a van one time or have seasonal needs, you should factor this into your estimate. It’s important to be as accurate as possible.

Why should you choose temporary van insurance?

If you don’t use your van all year round or are looking to borrow one for just a few days, you could look into getting cheap temporary van insurance. Whether you need van insurance for a day, a weekend or a month, Tempcover has you covered.

Our fully comprehensive short-term van insurance lets you pay for a time period that suits you – anything from 1 hour up to 28 days. This makes it the ideal cover for anyone borrowing a van to move house, transport a large item or simply borrowing one while your own vehicle is off the road.

A temp policy can also help you save money in the long term. It protects your No Claims Discount if you have an accident or need to make a claim. Temp van insurance is completely separate to an annual policy, so does not have any impact on any insurance you already have.

How to get cheap van insurance

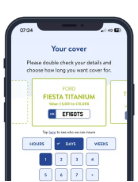

Tempcover IT… You can get a van insurance quote in under 2 minutes by following these four steps:

- Enter your details

- Get your quote

- Confirm declaration

- Purchase your policy

Temporary van insurance cover is a great way to achieve peace of mind behind the wheel, while still getting the best possible value for money.

If you know someone under 25 who wants to drive a van for a short period, why not use Tempcover’s cheap van insurance for young drivers. It will save on an annual policy and is truly flexible so they only pay for the time they need.

Reduce your risk and save money on van insurance

Because vans are often used to transport large goods or store expensive tools, they can be a target for thieves looking for high-priced items. Because of this, van insurance for business can be high in price.

Increasing the security of your van can keep your possessions safe and benefit you when it comes to your insurance premium. Many providers take your van’s security into account and will offer cheaper van insurance depending on how secure it is.

Increasing the security of your van can help save money on your van insurance quote as well as reducing the likelihood of theft.

Ways to make your van more secure

- Ensure you have the best locks available: look at installing deadlocks or slamlocks

- Make your vehicle locks as visible as possible to deter thieves

- Try to park off the road or, ideally, in a garage

- Install a CCTV camera over any regular driveways

- Install a dashcam

- Take valuables with you (or keep them out of sight)

- Install a GPS tracker, so you can find your van if it does get stolen

Drive your van safely can keep premiums down

Driving safely and sensibly can help reduce the cost of your van insurance. Vans can be intimidating to other drivers, so keep your distance and adhere to the rules of the road – including speed limits – to help reduce the chance of being involved in an accident.

The longer you drive without being involved in an accident, the greater your No Claims Discount will be. This can help reduce the cost of your van insurance over the years.

Will a smaller van have a lower insurance premium?

When you’re assessing how much you use your van, it’s worth considering whether it’s the right size for your needs.

All of the following may have an impact for your van insurance quote:

- Make

- Model

- Size

- Age

If you don’t need a large and powerful van, then you could consider trading it in for something cheaper and more economical.

A short-term van insurance policy provides you with the same level of comprehensive insurance as an annual policy, but for a period that works for you, so you can save money by only paying for what you need.

Frequently Asked Questions

What are the benefits of temporary van insurance?

With temporary van insurance, you can enjoy fully flexible and comprehensive coverage for times ranging from 1 hour to 28 days. This insurance won’t affect your No Claims Discount and as you only pay for the time you need, it’s perfect if you only occasionally use or borrow a van.

Am I eligible for temporary van insurance?

You are eligible for Tempcover’s temporary van insurance if you:

- Are aged 17-77 years old

- Hold a full UK driving licence

- Have been a permanent UK resident for the last 12 months

- Have no more than 7 licence points in the last 3 years

- Have not been disqualified from driving in the last 2 years

- Have had no more than 2 claims that you were at fault for in the last 3 years

- Have no criminal convictions

- Have not had a previous policy of insurance declared void by an insurer

How long does temporary van insurance last?

With Tempcover, temporary van insurance periods range from 1 hour to 28 days. This means you can tailor it to your exact needs.

Why is van insurance so high?

Vans are often used to transport larger items and those of higher value. Because of this, they’re more likely to attract thieves than a smaller car. The make, model, size, and age of your van can all impact insurance premiums.